The Losing Side

There’s an old Wall Street saying, “bull markets climb a wall of worry”.

This refers to the tendency of stock prices to increase in spite of different market fears that would normally result in a decline.

Things like heightened geopolitical risk in the Middle East, the Fed taking too long to act, election season volatility, high valuations, inflationary fears, union strikes closing down ports, etc.

Yet, the broader stock market indices are making new highs.

It’s why I always advocate a long-term thesis.

When you assess the current environment, it’s extremely bullish for asset prices.

The Fed is easing into a strong economy with stocks at record highs and low CPI prints + global liquidity is rising.

Read that again.

It’s a story I’ve telling for a while now. Dollar debasement is real and it’s about to get worse.

But you still see people psyoping themselves out of being allocated to the best debasement hedge out there - Bitcoin and - to a lesser degree - growth stocks.

Is the bull run already coming to an end? Let’s look at the history…

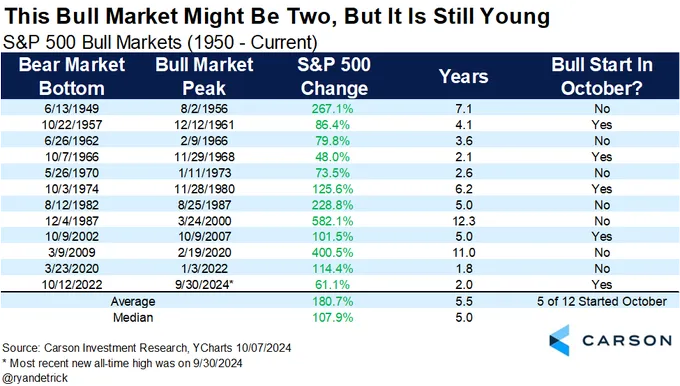

The bull market is about to turn two. Stocks are up 61% during this bull market, compared with the avg bull market lasting 5.5 years and gaining 181%.

If history is any guide, then we’re in for a fun ride over the next few years.

How do you lose? By not staying invested. By letting the naysayers and perma-bears scare you out of your positions.

That’s the losing side.

Not only are you missing out on upside, but your dollars are being devalued by the government and central bank.

To win is simple. Be invested.

Market Rotation

During bull markets - while a rising tide raises all ships - you want to make sure you’re reaping the rewards of different themes that are growing.

Ones that are growing faster than others.

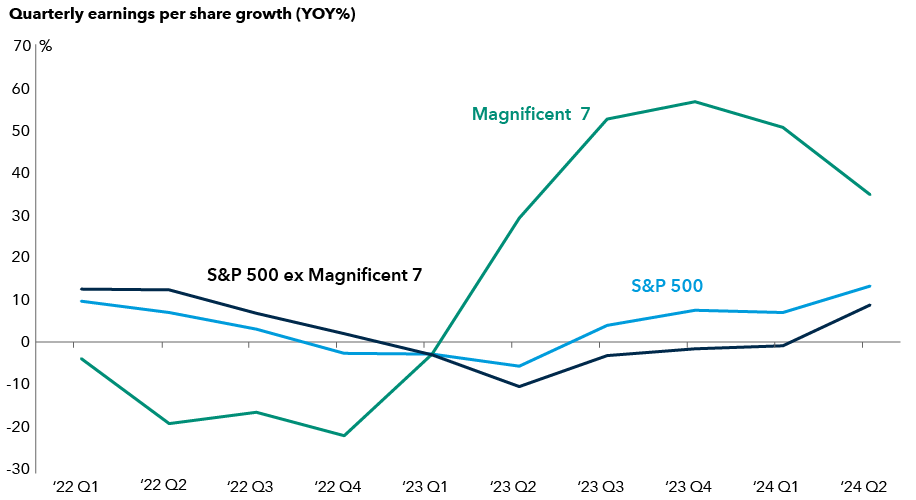

We’ve seen massive appreciation in the Mag 7 names - Nvidia, Meta, Google, Amazon, Tesla, Apple and Microsoft - as they’ve led the way for the past two years.

Many of those names I’ve written about a while ago and have appreciated greatly over that time.

Beyond those stocks, however, there is a broader ecosystem of firms that supply their parts or provide infrastructure critical to the success of the megacap companies.

In some ways, these firms provide avenues to access growth opportunities that may be more probable and durable.

Markets rotate.

Once one name is up a certain amount and is deemed as being sufficiently priced, money finds another name that is deemed undervalued.

This rotation could accelerate and continue for the next few years.

By the end of this bull market, you will find a whole litany of names up massively - not just the Mag 7.

There’s lots of long-term themes out there that are steadily growing without much mention. Themes that will likely continue for years to come - beyond the tech sector.